With nearly 60% of Canadian mortgages up for renewal in 2025-2026, homeowners face significant payment increases. Interest rates are projected to decline, but affordability remains a challenge. Mortgage originations are surging, and many borrowers are experiencing a 30-40% payment shock. This blog breaks down what’s happening, why it matters, and what steps you can take to navigate these changes effectively. If you’re a homeowner preparing for renewal, or a buyer wondering if now is the right time, here’s what you need to know.

The 2025 mortgage renewals in Canada are shaping up to be one of the most challenging financial shifts for homeowners in recent years. With rising payments, shifting affordability, and upcoming interest rate cuts, understanding the renewal landscape is more important than ever.

2025 Mortgage Renewals in Canada: What Homeowners Need to Know

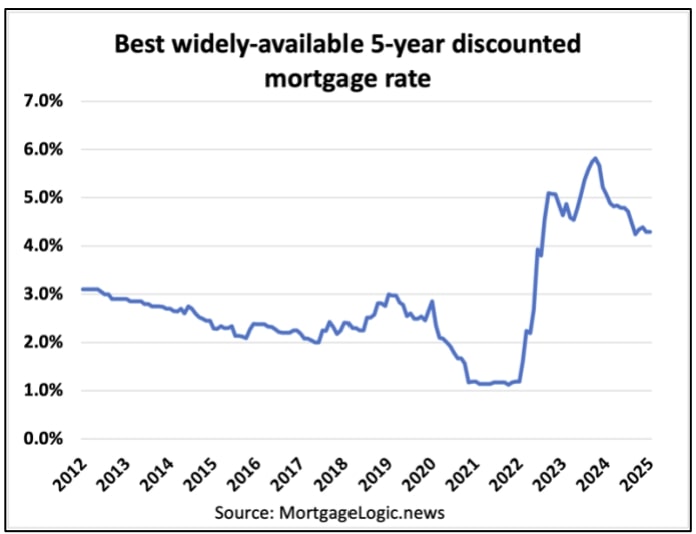

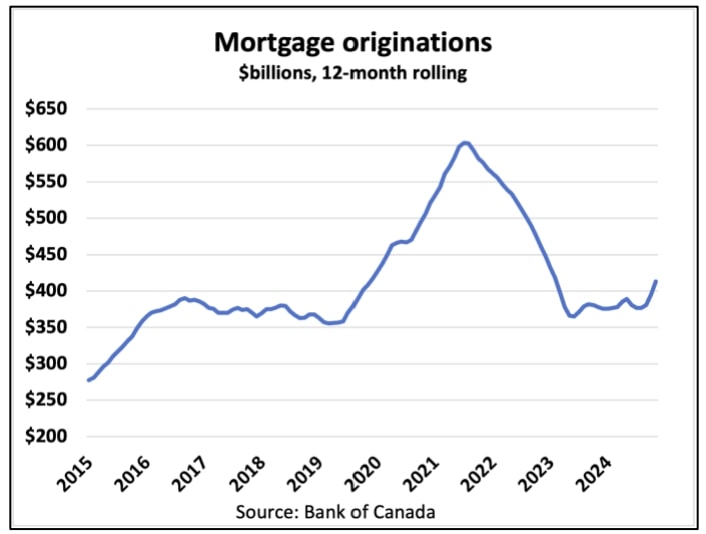

The mortgage market saw a massive wave of new loans, refinances, and renewals from mid-2020 to early 2022 when interest rates were at historic lows. Now, roughly 60% of all mortgages will be up for renewal in 2025 and 2026, meaning millions of homeowners will soon be facing a new reality.

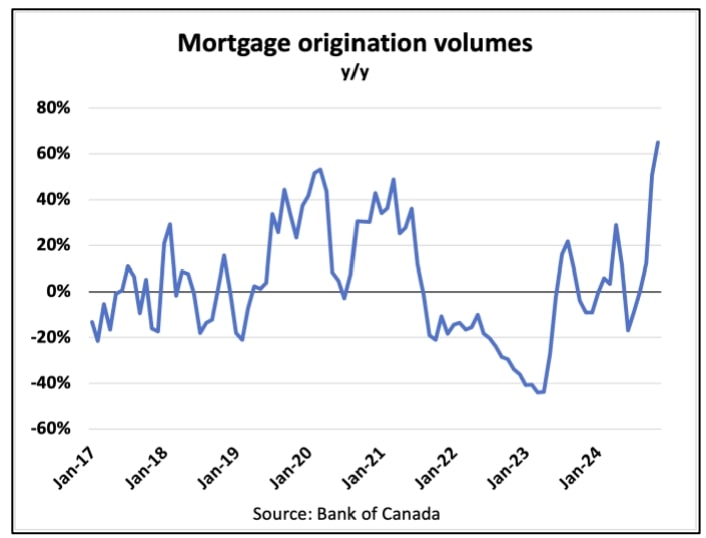

Mortgage Originations Are on the Rise

After a steep decline in mortgage activity following rate hikes, new mortgage originations have surged nearly 70% year-over-year in November 2024. This suggests that more buyers and homeowners are taking action in anticipation of interest rate shifts.

How 2025 Mortgage Renewals in Canada Will Impact Payments

One of the most pressing concerns for homeowners renewing in 2025 is the sharp increase in monthly payments. Those who locked in the best available rate in 2020 will now face significantly higher interest rates. Estimates suggest that homeowners could experience a 30-40% increase in mortgage payments upon renewal.

What Should Homeowners Do?

With these market dynamics in play, here are a few strategic moves to consider:

- Start Planning Early: If your mortgage is up for renewal in 2025-2026, now is the time to explore your options.

- Consider Fixed vs. Variable: While variable rates may offer lower costs in the future, fixed rates provide stability in uncertain times.

- Shop Around: Don’t automatically renew with your current lender—compare rates and negotiate for better terms.

Final Thoughts

While many homeowners renewing their mortgages will face significant payment increases, there are signs of relief on the horizon. Interest rates are projected to decline in 2025, and affordability is beginning to improve, which could help stabilize the market. However, for those renewing in the near term, financial pressures will remain a serious challenge.

Ready to Plan for Your Mortgage Renewal?

Let’s connect to discuss how changing mortgage conditions could impact your homeownership plans. Whether you’re buying, selling, or exploring your next move, I’m here to help.